Nifty @20K A New Milestone: A Deep Dive Into The Recent Surge

- saugatadastider

- Sep 23, 2023

- 14 min read

Updated: Sep 24, 2023

Tezi main hain sabhi genius, sabhi samajhte khud ko hero, mandhi ki aandhi main, bante aur bighadte firse zero. Banane aur bighadne main hi, nayi zindagi shuru hui hai, fir bhi apne hosh na khona, chahe party shuru hui hai-Vijay Kedia

Table Of Contents

Introduction: Setting the Stage for Nifty @20K's Milestone Journey.

NIFTY's Historic Achievement.

Nifty @20K: The Anatomy of a Growth Rally.

NIFTY Sectoral Dynamics.

Nifty @20K:The Sectors Behind the Surge.

The Flip Side of Nifty @20K: Sectors Under Pressure.

Influential Events and Their Impact on India's Market Sentiment.

Nifty @20K: Navigating the Challenges and Risks.

Nifty @20K and Beyond: What the Crystal Ball Says.

Conclusion: The Nifty @20K Saga Summarized.

Introduction: Setting the Stage for Nifty @20K's Milestone Journey

The Indian stock market, represented by the Nifty 50 index, has been a beacon of resilience and growth in recent times. As we navigate through 2023, the Nifty has not only showcased its robustness but has also set significant milestones that are worthy of attention and analysis.

In March 2023, the Nifty began its strong rally, gaining over 1% and marking a close at 17,359.75. This momentum was not short-lived. By July 2023, the index had surged by 15% since March, touching an all-time high of 19,991.85 on July 20th. The crescendo of this performance was witnessed in September when the Nifty 50 index gracefully crossed the 20,000 mark for the first time. This ascent to 20,000 was anticipated in July, but the index fell short by a mere eight points. The journey from 19,000 to 20,000 was swift, taking only 52 trading sessions.

Several factors have fueled this impressive rally. The inflow from Foreign Institutional Investors (FII) has been a significant catalyst, bringing in substantial capital that has elevated stock prices. On the domestic front, cues such as robust corporate earnings, encouraging economic data, and government policies have bolstered the market's confidence. Additionally, global factors, including the easing of trade tensions and accommodative stances from central banks worldwide, have further enhanced the positive sentiment in the Indian stock market.

This article serves as a continuation of our previous piece, "India 2023: Stock Market Surge, Key Factors & Forecasts". In that article, we delved into the macroeconomic factors propelling the Indian Capital Market's growth over the past six months. Topics such as the increasing confidence of FII & DII, stabilization in US federal policies, corporate earnings reverting to pre-COVID levels, and the surge in direct retail investing in India were discussed in detail. We also highlighted the positive GDP growth trend forecasted for FY23-24 and the impact of the widespread vaccination drive on the market. For a comprehensive understanding of these factors and more, we encourage our readers to visit our website and explore the article in its entirety.

As we proceed, this article will focus on the recent milestones achieved by Nifty, providing a deeper understanding of the sectors driving this growth, the challenges faced, and what the future holds for the Indian stock market.

NIFTY's Historic Achievement

The Indian stock market has been a focal point of global attention, especially with the Nifty 50 index setting new records and achieving significant milestones. As we delve deeper into the intricacies of these achievements, it's essential to understand the broader context and the factors that have propelled the Nifty to these heights.

Nifty @20K: The Road to a Historic 20,000

On the 11th of September 2023, the Indian stock market witnessed a historic moment. The Sensex surged by 528 points, reclaiming the 67,000 level. Concurrently, the Nifty scaled the monumental 20,000 mark for the first time, marking its seventh consecutive winning session. This achievement wasn't just a number; it was a testament to the robustness and resilience of the Indian stock market.

Breaking Records: Nifty's Unprecedented High of 20,063.45

Merely three days later, on the 14th of September 2023, the Nifty50 didn't just stop at touching the 20,000 mark but went on to set a record closing high of 20,063.45. This was not just another number but a reflection of the market's confidence and the positive sentiment surrounding the Indian economy.

Nifty Through the Ages: A Historical Perspective

The journey to 20,000 was not without its challenges. The Nifty 50 index's ascent to this mark was swift, taking only 52 trading sessions. While it was poised to cross the 20,000 mark in July, it fell short by a mere eight points, peaking at 19,992 before reversing. Despite these minor setbacks, the Nifty showcased its strength, recovering nearly 700 points from recent lows around 19,200.

Earlier in July, the Nifty was on a formidable upward trajectory. On July 20, 2023, it reached an all-time high of 19,991.85, marking a significant phase in its journey. This rally, one of the most potent in Nifty's history, was driven by a myriad of factors, both domestic and global. However, as with all market movements, it's crucial for investors to approach with caution, understanding the inherent risks and focusing on long-term strategies.

The Almost There Moment: Nifty @19,991.85 in July

July 2023 was a significant month for the Nifty 50 index. It was not just about the numbers but the momentum and the positive sentiment that drove the index. On July 20, the Nifty touched an all-time high of 19,991.85, reflecting the market's optimism and the underlying strength of the Indian economy.

As we continue to explore the nuances of Nifty's recent achievements, it's essential to understand the broader economic landscape, the challenges, and the opportunities that lie ahead. The journey of the Nifty is not just about numbers but the stories, the strategies, and the aspirations of millions of investors.

Nifty @20K: The Anatomy of a Growth Rally

The Indian stock market's recent rally has been nothing short of spectacular. However, a closer look reveals that the growth has been uneven across different segments of the market. The Nifty Midcap, Nifty Large-cap (Nifty50), and Nifty Smallcap indices have all experienced varying degrees of growth, each telling its own story of market dynamics, investor sentiment, and economic factors.

Midcap Marvel: The Unsung Heroes of Nifty @20K

The Nifty Midcap 100 index has been a standout performer in 2023, registering a remarkable surge of nearly 27%. The last month alone saw it rally by approximately 7%. This robust growth underscores the increasing investor confidence in mid-sized companies, which are often seen as the backbone of the Indian economy. Their agility, adaptability, and potential for high growth make them attractive investment options.

Nifty Large-cap's (Nifty50) Holds its Ground

The Nifty50, representing the large-cap segment, has seen a steady rise of about 10% in 2023. With a gain of 1.5% YTD and 3.07% over the past month, it reflects the stability and resilience of the major players in the market. These companies, with their vast resources and established market presence, offer a safe haven for investors, especially in turbulent times.

Smallcap Surge: The Dark Horses of Nifty @20K

The Nifty Smallcap 100 index has mirrored the performance of its midcap counterpart, surging by an impressive 28% in 2023. Small-cap companies, with their nimble operations and high growth potential, have attracted significant investor interest. However, it's essential to approach this segment with caution, given its inherent volatility.

Bulls vs. Bears: The Advance-Decline Ratio Behind Nifty @20K

The Advance vs. Decline ratio is a crucial metric that provides insights into market sentiment. A ratio consistently above 1 indicates a bullish market sentiment, suggesting that more stocks are advancing than declining. Post-March 2023, the Nifty's Advance V Decline ratio has consistently remained above this threshold, reinforcing the positive momentum in the market.

As we continue to dissect the growth rally of the Nifty indices, it becomes evident that while the numbers are promising, they come with their own set of challenges and risks. Investors need to be well-informed, strategic, and cautious to navigate this dynamic landscape successfully.

NIFTY Sectoral Dynamics

In the vast landscape of the Indian stock market, NIFTY stands as a beacon of performance, reflecting the health and vibrancy of the nation's economy. But behind the composite index's numbers lies a diverse array of sectors, each with its own story and influence. The 'NIFTY Sectoral Dynamics' delves into the intricate tapestry of these sectors, shedding light on their individual contributions and interplay that collectively drive NIFTY's movements.

Nifty @20K:The Sectors Behind the Surge

The Indian stock market's recent rally has been characterized by significant sectoral variations. While the broader market indices have shown impressive growth, certain sectors have outperformed others, driving the overall market sentiment. Let's delve deeper into the top-performing sectors and understand the forces behind their surge.

NIFTY REALTY: Building on Solid Foundations

The Realty sector's impressive return of 10.03% can be attributed to several factors:

Budgetary Support: The 2023 budget provided significant impetus to the real estate sector, making housing more accessible and affordable.

Urban Development: A renewed focus on urban development and new constructions has spurred growth in this sector.

Government Initiatives: Schemes like the PM Awas Yojana have incentivized builders to cater to a broader segment of the population.

Demographic Factors: The combination of increasing population and urbanization has naturally boosted demand in the realty sector.

Tax Benefits: The capping of capital gain tax has made real estate investments more attractive.

Infrastructure Push: Government-led infrastructure development has indirectly benefited the realty sector.

NIFTY PSU BANK: Banking on Positive Sentiments

The PSU Bank sector's rally, with a return of 11.43%, was driven by:

Valuation Attractiveness: Compared to private bank stocks, PSU bank stocks were attractively valued, drawing significant investor interest.

Bond Index Inclusion: The potential inclusion of Indian government bonds in JPMorgan Chase's bond index boosted the sector.

Margin Expansion: Analysts predict higher margin expansion for PSU banks compared to many private banks over the next few years.

Record Highs: The PSU bank index consistently hit record highs, reflecting strong investor confidence.

Outperformance: In 2023, PSU banks outperformed both the broader bank index and private banks.

NIFTY IT: Digital Transformation Fuels Growth

The IT sector's growth, marked by a return of 6.87%, is a testament to:

Global Demand: With businesses worldwide investing in digital transformation, Indian IT firms have seen a surge in demand.

Rupee Depreciation: A weakening rupee has made Indian IT stocks more attractive to foreign investors.

NIFTY PSE: Government Spending Spurs Growth

The PSE sector's growth can be attributed to the government's spending patterns, which have led to a re-rating of PSU stocks. However, analysts advise caution as these stocks might be overvalued.

NIFTY METAL: Strengthening the Core

The Metal sector's rally, marked by a return of 8.51%, was influenced by:

Chinese Demand: Expectations of a revival in demand from China played a significant role.

Domestic Expenditure: Increased domestic infrastructure spending and optimistic projections for Q3FY23 boosted the sector.

Aatmanirbhar Bharat: The government's focus on domestic manufacturing under the Aatmanirbhar Bharat initiative presents significant opportunities for the metal sector.

In conclusion, while the broader market indices have shown commendable growth, it's the sectoral dynamics that provide a more nuanced understanding of the market's performance. Each sector tells its own story, influenced by a combination of domestic and global factors, government policies, and investor sentiment.

The Flip Side of Nifty @20K: Sectors Under Pressure

In the recent market rally, certain sectors have shown a slower growth compared to others. This analysis delves into the reasons behind the subdued performance of these sectors, providing insights into the challenges they faced in September 2023.

NIFTY OIL & GAS: The Slippery Slope

The NIFTY Oil & Gas sector registered the most minimal growth, with an increase of just 0.02%. Several factors contributed to this sluggish performance:

Market Uncertainty: The looming threat of a recession and a pessimistic macroeconomic forecast have negatively impacted the market's perception of oil and gas commodities for 2023 and the foreseeable future.

Reduced Demand: A significant portion of the decline in demand came from the agricultural sector. The diminished sales of tractors led to a consequent decrease in diesel consumption.

Supply Disruptions and Price Volatility: The oil and gas industry has always been susceptible to supply disruptions and price fluctuations. However, the current scenario is distinctive. A combination of economic, geopolitical, trade, policy, and financial elements have intensified the problem of underinvestment, prompting a recalibration in the broader energy market.

NIFTY FMCG: Fast-Moving Concerns

The NIFTY FMCG sector, with a growth of 0.15%, also lagged behind during the recent market rally. The reasons for this subdued performance include:

Inflation: Inflation poses a significant challenge for FMCG companies. Escalating commodity prices can compress margins unless these costs are transferred to consumers through price increments.

Slow Growth: The FMCG sector has been witnessing slow growth for multiple quarters. In urban markets, consumers are gravitating towards more affordable daily essential brands, while rural growth has decelerated.

Expectation of Fewer Price Hikes: FMCG firms anticipate fewer price increases, which could potentially affect their revenue growth.

Covid-19 Impact: While the industry is robust enough to endure another hit from Covid for at least two more quarters, a global recession might have a slight impact.

Rural Demand: The demand from rural areas remains a point of concern.

NIFTY PHARMA: A Dose of Reality

The NIFTY Pharma sector, with a growth rate of 1.2%, was another sector that didn't perform as well as expected during the recent market rally. The reasons for this include:

Price Erosion in the US: The US has witnessed price erosion, which has been a primary cause for the downturn in pharma sector stocks over the past few years. However, this trend seems to be stabilizing.

Cost Inflation and Pricing Pressures: The industry is currently wrestling with cost inflation and pricing challenges.

These combined factors might have led to the NIFTY Pharma sector's lower growth during the recent market rally.

In conclusion, while these sectors faced challenges in September 2023, it's essential to understand the broader economic and industry-specific factors that influenced their performance. As the market continues to evolve, these sectors may see changes in their growth trajectories based on global and domestic developments.

Influential Events and Their Impact on India's Market Sentiment

In recent times, India has witnessed a series of significant events that have not only showcased its prowess on the global stage but also influenced the market sentiment, both domestically and internationally. These events have played a pivotal role in shaping the perception of India as a rising global power, thereby attracting increased attention from foreign and domestic investors. Let's delve into these influential events and understand their impact.

ISRO's Chandrayaan 3.0 Mission:

The Indian Space Research Organisation (ISRO) achieved a monumental feat with the successful launch of Chandrayaan 3.0. India became the first country in the world to land on the south pole of the moon. This accomplishment not only showcased India's advanced technological capabilities but also reinforced its position as a leading player in space exploration. The success of this mission has bolstered the confidence of investors in India's technological and research sectors.

ISRO's ADITYA L1 Solar Space Mission:

Another feather in ISRO's cap was the successful launch of the ambitious ADITYA L1 solar space mission. This mission aims to study the sun and gather crucial data that can have far-reaching implications for understanding space weather and its impact on Earth. The success of ADITYA L1 further cements India's reputation as a pioneer in space research and exploration.

G20 Summit in India 2023:

Hosting the G20 Summit in 2023 was a significant milestone for India. It provided a platform for India to showcase its leadership capabilities on the global stage. The summit saw discussions on various global issues, and India's role in these discussions highlighted its rising geopolitical influence. The successful hosting of such a prestigious event has positively impacted the perception of India as a global leader, attracting increased interest from international investors.

In conclusion, these events, combined with India's rising geopolitical influence, have significantly contributed to the bullish sentiment observed among foreign and domestic investors. The positive market sentiment is a testament to India's growing stature on the global stage and its potential for future growth and development.

Nifty @20K: Navigating the Challenges and Risks

The Indian market, represented by its major indices, Sensex and Nifty, has been influenced by a myriad of factors. While there have been positive events and developments that have propelled the market forward, certain challenges and risks have also played a role in shaping its trajectory. Let's delve into the three major challenges that the Indian market is currently grappling with.

Low Domestic Agricultural Output

Agriculture is the backbone of the Indian economy. Despite accounting for only around 14 percent of the country's GDP, it employs a staggering 42 percent of the total workforce. Recent data indicates a decline in the GDP from agriculture, which decreased to 5139.46 INR Billion in the second quarter of 2023 from 6071.31 INR Billion in the first quarter. This decline has had a significant impact, particularly on the NIFTY Oil & Gas Index, given the interdependence of the agricultural and energy sectors.

Stagnation in the Manufacturing Sector

The manufacturing sector, a crucial pillar of the Indian economy, has been experiencing slower growth. The NIFTY INDIA MANUFACTURING index recorded a growth of 3.94%, which is below the average growth rate of 5.11%. Several factors have contributed to this slowdown. The imposition of a 28% tax on diesel vehicles, coupled with an additional cess based on engine capacity, has been a deterrent. Furthermore, manufacturing, which holds a significant weight of 77.6% in the Index of Industrial Production, grew at its slowest pace of 3.1% in three months as of August 2023.

Inflationary Concerns

Inflation remains a persistent challenge for the Indian economy. While there was a slight dip in the inflation index from 7.44% in July to 6.83% in August 2023, it still remains outside the Reserve Bank of India's comfort range of 6%. Persistent inflation can erode purchasing power and dampen consumer sentiment, which in turn can impact market dynamics.

Nifty @20K and Beyond: What the Crystal Ball Says

The Indian market, after its rally in September 2023, has garnered significant attention from analysts, investors, and global institutions. The trajectory of the market is influenced by a myriad of factors, both domestic and international. Based on insights from various sources, here's a detailed look into the future forecast of the Indian market:

Consolidation Phase: Post the rally, analysts predict that the domestic stock markets might enter a phase of consolidation. This means that the market could experience a period of stability without significant upward or downward movements. This consolidation is expected to continue for a few sessions before any potential upward trajectory.

Overvaluation Concerns: There are rising concerns about the overvaluation of small and midcap indices. Such concerns could have a ripple effect on the broader domestic market, potentially impacting investor sentiment and market dynamics.

IMF's Positive Outlook: The International Monetary Fund (IMF) has recently revised its growth forecast for India upwards. This revision is attributed to the robust growth witnessed in the last quarter of the previous year, primarily driven by domestic investments.

All-Time Highs: Both the Sensex and Nifty achieved all-time highs in July. Analysts remain optimistic about these indices, projecting that they will continue to yield positive returns in the coming years.

Growth Projections: The economic outlook for India remains promising. Forecasts suggest that India's growth rate will hover between 6% and 6.3% in FY2023–24. Moreover, if global uncertainties diminish, India's growth rate could even surpass 7% in the subsequent years.

While these forecasts paint a positive picture for the Indian market, it's crucial to approach them with a degree of caution. The actual market performance can deviate from these predictions due to various factors, including global economic scenarios, changes in government policies, corporate earnings reports, and shifts in investor sentiment.

Conclusion: The Nifty @20K Saga Summarized

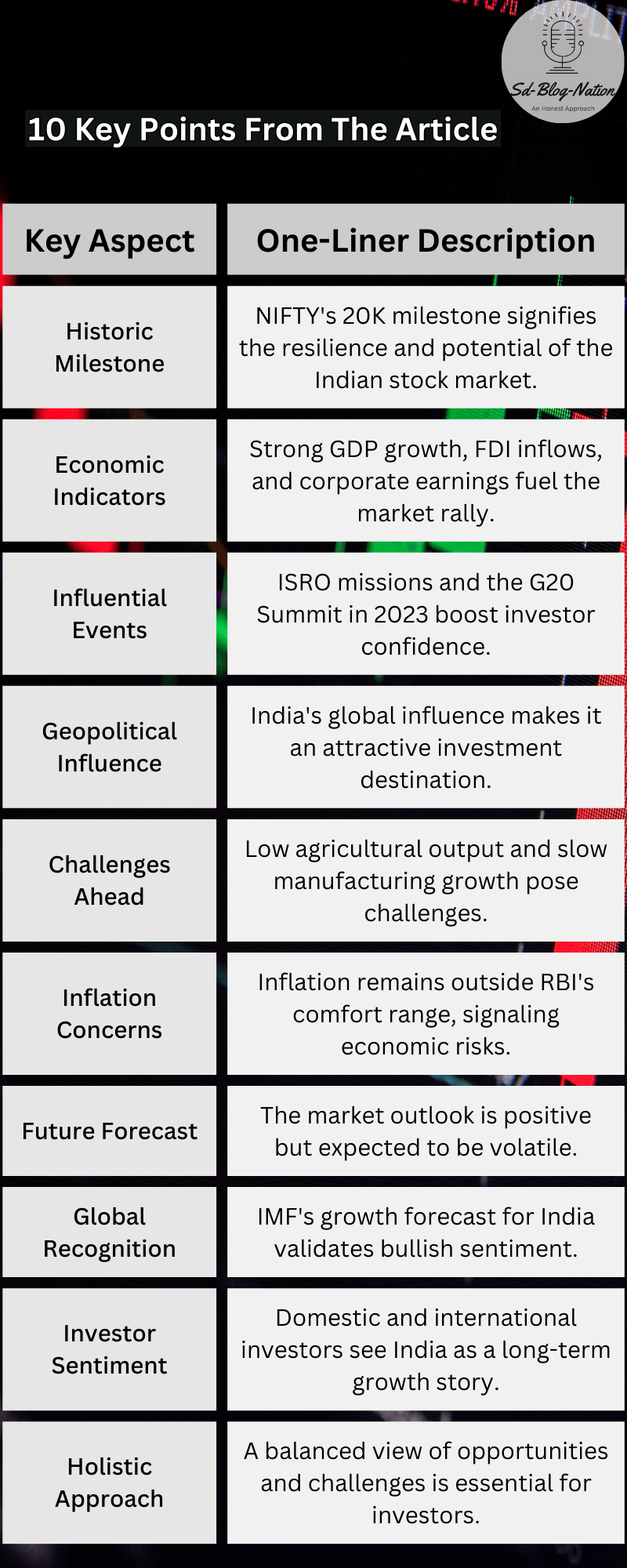

Conclusion:

Historic Milestone: NIFTY reaching its new milestone 20K point is not just a number but a testament to the resilience and potential of the Indian stock market.

Economic Indicators: The rally in the stock market is backed by strong economic indicators, including GDP growth, FDI inflows, and robust corporate earnings.

Influential Events: Events like successful space missions by ISRO and the G20 Summit in India in 2023 have significantly boosted investor confidence.

Geopolitical Influence: India's rising geopolitical influence on the global stage has further solidified its position as an attractive investment destination.

Challenges Ahead: While the market has shown positive trends, challenges like low agricultural output and slow manufacturing sector growth cannot be ignored.

Inflation Concerns: The inflation index, though showing a slight decrease, remains outside the RBI's comfort range, indicating potential economic challenges.

Future Forecast: Despite the challenges, the future forecast for the Indian market remains positive, albeit with expected volatility.

Global Recognition: International institutions like the IMF have recognized India's growth potential, further validating the bullish sentiment.

Investor Sentiment: Both domestic and international investors are optimistic about the Indian market, with many considering it a long-term growth story.

Holistic Approach: It's essential for investors and market enthusiasts to adopt a holistic approach, considering both the opportunities and challenges in the market.

Call to Action:

For those keen on diving deeper into the intricacies of the Indian stock market and understanding the factors driving its growth, we recommend reading our comprehensive article, "India 2023: Stock Market Surge, Key Factors & Forecasts". This article provides a detailed analysis, offering readers a sense of continuity and a broader perspective on the market dynamics. Don't miss out on this insightful read!

Reference

13) NSE India

Comments